The regular working hours in Malaysia are eight hours a day and 48 hours a week. Malaysias basic labour law for Employers.

Everything You Need To Know About Running Payroll In Malaysia

Other rates for overtime work are as follows.

. In Malaysia matters concerning working hours and wages are regulated under the Employment Act 1955 and Minimum Wages Order 2016. According to Regulation 6 of the Employment Termination and Lay-Off Benefits Regulations 1980 employees whose monthly salary is RM2000 and below and who falls within the purview of the Employment Act 1955 EA 1955 must be entitled to retrenchment benefits as stated below depending on their tenure of employment-. Not more than 8 hours work in one day based on a 6-day working week or 9 hours in one day.

Select a tax calculator from the list below that matches how you get paid or how your salary package is detailed. Working hours permitted under Akta Kerja 1955. What are the statutory deductions from an employees salary.

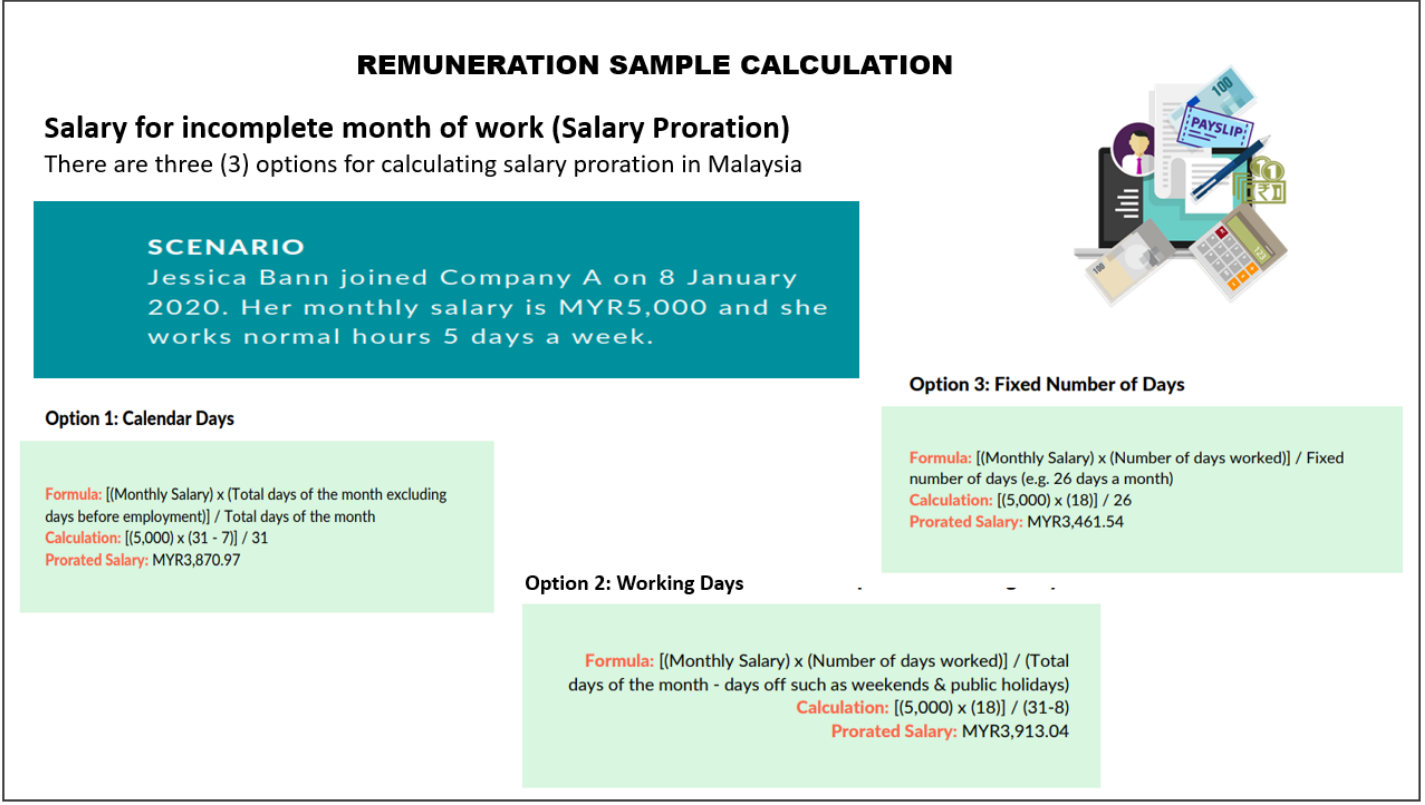

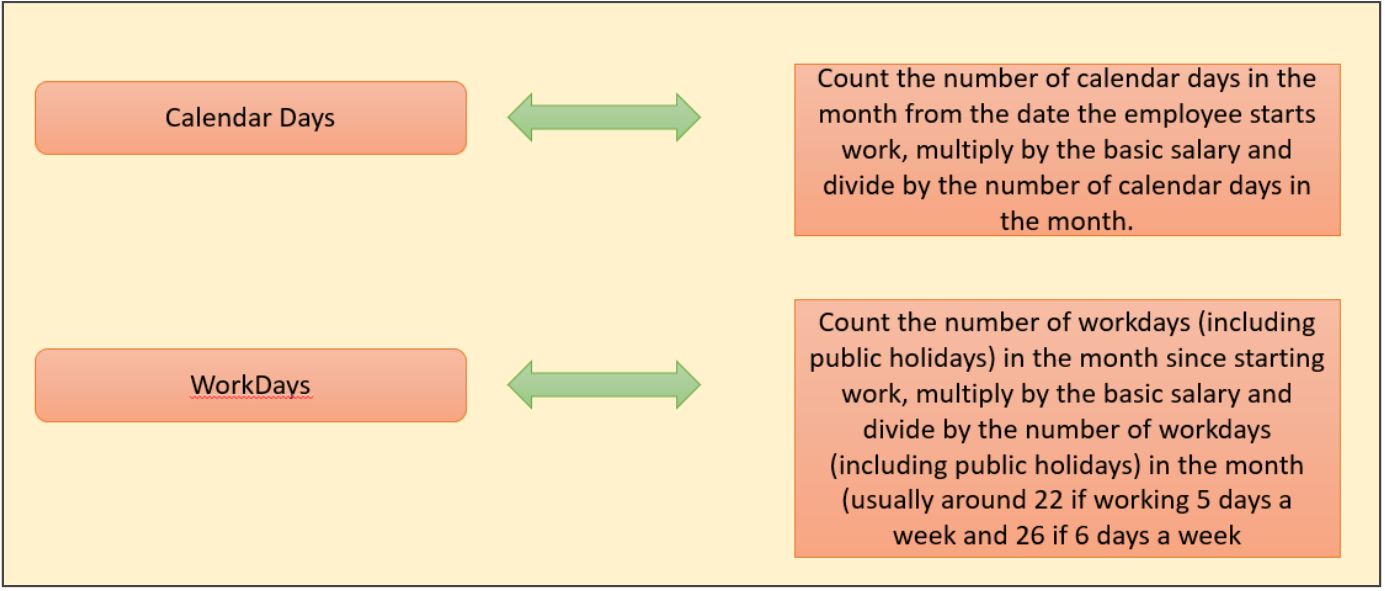

Every 5 consecutive hours followed by a rest period not less than 30 minutes. Labour Law Malaysia Salary Calculation Complete Guide Payroll Module To calculate the daily rate you can divide the monthly salary by either of. The legal framework to the Malaysian employment and industrial relations ecosystem is generally provided by the Employment Act 1955 and the Industrial Relations Act 1967.

Employment Act 1955. The new law will impose a fine of 10000 ringgits on any employer found guilty of requiring an employee to retire prior to age 60. Below you will find a brief summary of the various labour issues.

However most of the Employment Act only applies to employees who fall within the scope of the Act. Then calculate the overtime pay rate by multiplying the hourly rate by 15 and then multiply that figure with the number of overtime hours worked. A worker cannnot work for directly for 5 hours non stop without a minimum rest time for 30 minutes.

Ordinary Rate of Pay OPR. Annual Salary Calculator Malaysia Annual Salary is the total amount of salary calculator earned by an employee on an annual basis before any Employee Deduction such as EPF Sosco EIS and Income Tax. An employer and employee may agree that the wages of the employee shall be paid at an agreed rate in accordance with the task ie.

The specific amount of work to be performed and not by the day or by the piece. However we usually total up employee annual salary after all the deduction made. The Act applies to employees whose salary is below RM2000 per month.

However the legislation does not prevent employees from choosing to retire earlier than age 60 if the service contract or collective agreement that applies to their job permits an earlier retirement date Quick Links. The ordinary rate of pay on a monthly basis shall be calculated according to the following formula. Ordinary rate of pay opr.

The Employment Act EA applies to employees employed in West Malaysia who. Salary for January 2016 RM 1000 x 20 31 RM 64516 The calculations is base on the number of days in a month. The Employment Act sets out minimum statutory benefits and entitlements.

A worker cannot work more than 8 hours per day and more than 48 hours per week. The Employment Act 1955 is the most important labour law in Malaysia. RM50 8 hours RM625.

Which means Net Salary 12. About the Employment Act 1955 is only applicable to pinensula Malaysia while Sabah and Sarawak have their own laws eg Sabah Labour Ordinance and Sarawak Labour Ordinance. Never miss an important deadline with our detailed compliance calendar.

Malaysia Law On Overtime. Earn a monthly salary of 2000 Malaysian ringgit and below. Annual Salary After Tax Calculator.

To calculate the daily rate you can divide the monthly salary by either of. Base and adjustment criteria. Section 2 1 defined wages as means basic wages and all other payments in cash payable to an employee for work done in respect of his contract of service but does not include.

60B of Malaysia Employment Act 1955. Base criteria include Poverty Line Income PLI and Median Wage while the adjustment criteria include changes in Consumer Price Index CPI Productivity Growth P and Real Unemployment Rate UE. Regardless of salary quantum are.

The criteria to decide minimum wages are divided into two. C Valid before 1 January 2012 December 2011 salary and previous month The main source of labour law is the 1955 Labour Code. The employer can use any other formula as he wished as long as the answer he gets is more favourable to the employee than the above answer.

It is not based on the number of working days in the month. Here this would be RM625 x 15 x 2 hours RM1875. Divide the employees daily salary by the number of normal working hours per day.

Basically it means Gross Salary 12. The formula based on 26 days is the minimum hourly rate according to the employment act but. If an employee is required to work overtime on a normal working day heshe must be paid 15 times the hourly wage rate.

Monthly rate of pay26 days Section 60I 1A EA. The key legislation in Malaysia related to employment matters is the Employment Act 1995 or EA 1995. The rights of workers who earn more than RM2000 per month are covered by the Contract Law as per the Contracts Act 1950.

Calculate your income tax in Malaysia salary deductions in Malaysia and compare salary after tax for income earned in Malaysia in the 2022 tax year using the Malaysia salary after tax calculators. Normal working hours 1.

Formul St Partners Plt Chartered Accountants Malaysia Facebook

Salary Formula Calculate Salary Calculator Excel Template

Salary Formula Calculate Salary Calculator Excel Template

Your Step By Step Correct Guide To Calculating Overtime Pay

Everything You Need To Know About Running Payroll In Malaysia

Your Step By Step Correct Guide To Calculating Overtime Pay

Salary Calculation Dna Hr Capital Sdn Bhd

How To Calculate Overtime Pay From For Salary Employees Youtube

Your Step By Step Correct Guide To Calculating Overtime Pay

Service Contract Offer Letter How To Draft A Service Contract Offer Letter Download This Service Contract Offer Lettering Download Letter Example Templates

Malaysia S New Minimum Wage To Take Effect From 1 May 2022 What Employers Should Note

Rta School Bus Driver Vacancy School Bus Driver Vacanciesin Dubai 2018 Rta School Bus Jobs 2018 Dubai Bus Driver Job Driver Job School Bus Driver Bus Driver

Your Step By Step Correct Guide To Calculating Overtime Pay

Salary Formula Calculate Salary Calculator Excel Template

Important Things In Your Payslips Need To Check Payroll Template National Insurance Number Payroll Software

Your Step By Step Correct Guide To Calculating Overtime Pay

Salary Formula Calculate Salary Calculator Excel Template

Your Step By Step Correct Guide To Calculating Overtime Pay

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog